Sometimes we may wonder, what Ongoing Risk-Based Customer Due Diligence means. The easiest answer is that we need to constantly monitor our relationship with a customer bearing in mind the diagnosed risks embedded in this relationship. When we translate this model into practice we could consider three variables:

- static customer information collected, verified and documented at the onboarding of the relationship

- changes to the static customer information identified in the course of the relationship, verified and documented and finally

- understanding of the financial transactions between us and our customers, or in case of AML/CFT compliance the known incoming and outgoing transactions of the the customer executed in the course of relationship with the obliged institution

– and the risks associated with these variables. More about the risk assessment and risk scoring can be found in the prior blog entries.

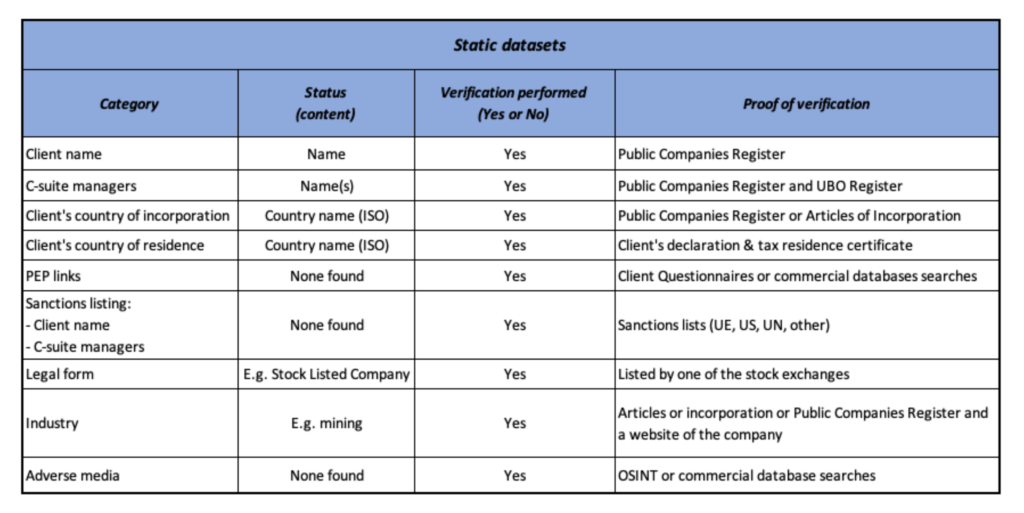

The simplified model of the static customer information can be found below:

The static customer information need to be monitored for changes. Frequency of change monitoring depends on available technology. It may be performed on regular basis, e.g. annually or biannually, or constantly, in particular in respect to the e.g. sanctions.

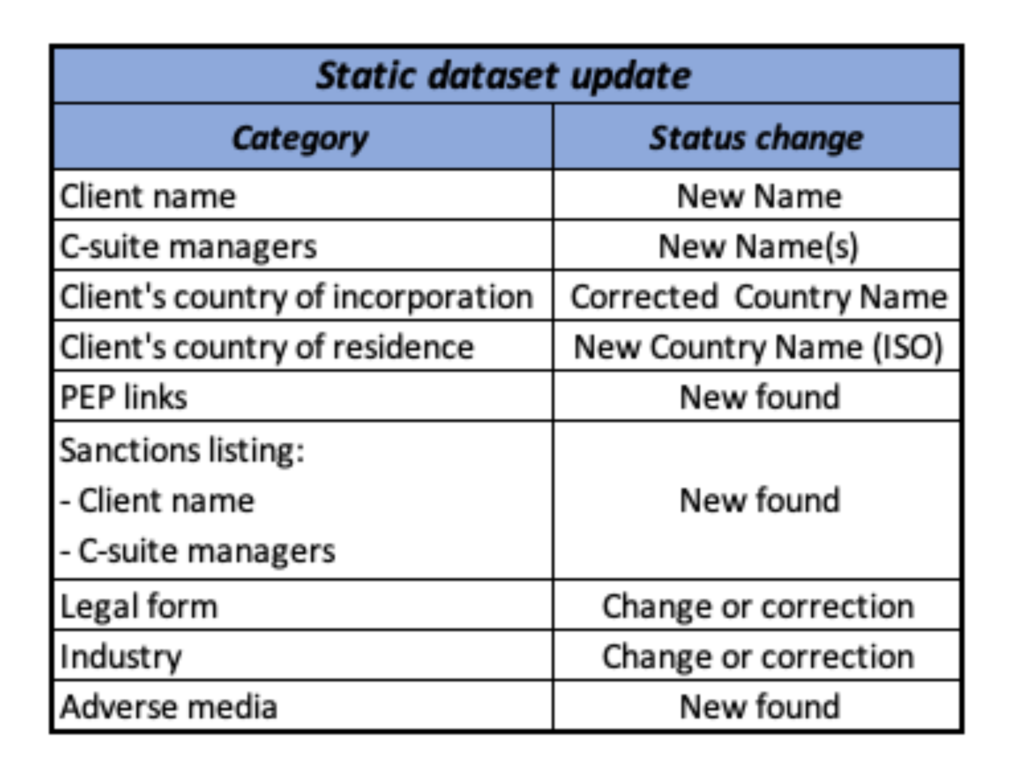

Possible change monitoring model has been presented in the below table:

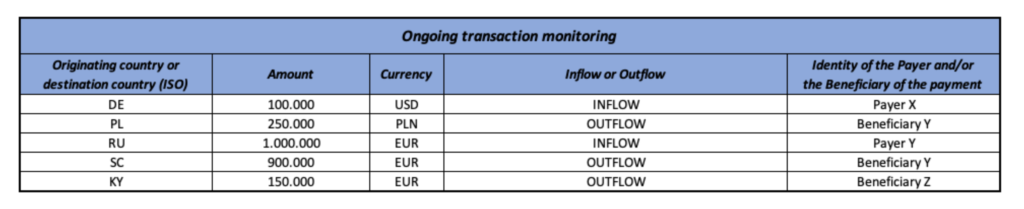

On top of the static customer information and its changes we will also encounter customer transactions that we also need to monitor for consistency with our understanding of the customer’s business relationship with us and our risk appetite associated with this relationship. Possible sample transaction monitoring model can be found in the below table:

All the above is often performed with application of sophisticated technology platforms, however as you may see the basic concept behind these platforms is pretty simple and for low volume of customers and transactions the DIY approach may suffice.

More blog entries to come. thank you for bearing with me 🙂